I filed my first case in the CCB last week and thought I’d share a bit about the initial process.

TL:dr It’s designed to be non-lawyer friendly but I’d still encourage using one anyway.

First, don’t do anything without reading the handbook beforehand. It will make a huge difference in understanding how the forms work as well as the process as a whole. It will also give you the chance to see what things you might not understand fully, so that you can ask questions (preferably of a lawyer, not some rando on social media). For example, when you enter your certificate number, there is a very specific way to do that and it’s not “VA2-222-2222” like you would expect. Many of those little questions will be answered by the handbook.

Second, you may be tempted to look at several of the other cases to see how others are approaching the process. I did that and this can be very helpful to attorneys, but I’m afraid it may only make things worse for non-lawyers, as there is some crazy out there already. If you don’t know how filings work or what the elements are to your claim, that is, what you’ll need to plead and prove, this is where you can get into trouble. For example, there is one case where the claimant (plaintiff, in regular federal court) is essentially trying to sue the US Copyright Office. That’s not what the CCB is for and those filings will send you into a rabbit hole of bad examples. So, for most of you, I’d say skip this unless you want to run something by your attorney to see if it’s a good example to follow or maybe you have litigated in the past and know how the process usually works.

Third, gather all your evidence and plan your case. You need to know what you need to prove (the elements of infringement claim) and what you have to get you there (evidence). Do you have any holes in your evidence? Now’s the time to try and fill those gaps. For example, you should (at least) have a copy of the original work and copies of the infringing uses and a copy of your registration certificate, if you have one (in the CCB, you have to have at least applied for registration to start a claim, but it’s better to have one in hand already)—all that is your evidence.

You should also take the time to research your opponent, if you haven’t already. You’ll need contact information of some kind, at the very least. Gather all this information and organize it into some sort of cohesive story. In regular court, we attorneys do this in the form of the complaint we draft and file; here, there is no need for a formal complaint, but a document with the same information will be helpful.

To create the document, write a list of how and when the work was made, when it was first published (published for the purposes of copyright law—not published in the normal English sense), when it was registered, when you discovered the infringement, how you did that, and then what steps you took after your discovery of it.

And if you haven’t already tried to negotiate a settlement before filing, now might be a good time to consider that first. It will look better if you try to get the matter worked out before filing and, if it works, then you won’t have to file! In the case of the filing I just did, we’ve been trying to get the respondent (defendant) to negotiate reasonably for almost a year before my client decided to take this step.

Anyway, back to the doc… in some sort of bullet point-like list, tell the story and, in it, point to the evidence you have. Think simple, declarative sentences. For example:

Claimant created the photograph on June 1, 2020.

Claimant first published the photograph on June 15, 2020, when she offered it for licensing on her website at https://www.photographer.com/art.jpg.

Claimant registered her copyright in the photograph, with others, receiving certificate No. VA2-222-2222 with an effective date of July 1, 2020. [Exhibit A: USCO certificate]

etc.

After you have all that done, you can start to fill out the claim forms. It will be much easier with the timeline and the evidence in order, but remember that you can always stop and save your progress, then come back to the forms later. You should, at the end of the claim, upload pdfs of the timeline and the evidence you have. Also, make the file names for these things clear, like “EX A: Cert va2-222-222.pdf.” You don’t need to do all that, but it will make reviewing things easier on the CCB attorney assigned to review the claim and hopefully get you to the service process faster.

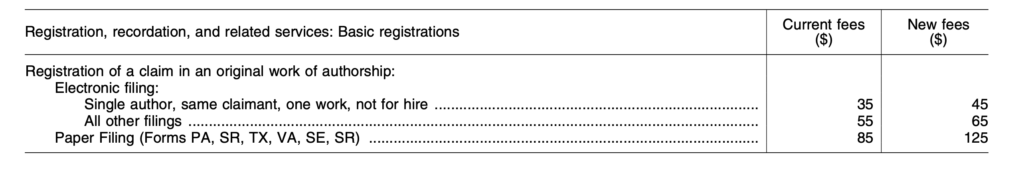

Pay your $40 (the other $60 is due later, if the defendant doesn’t opt-out) and then, like me now, you sit back and wait for the CCB attorney to review the claim to make sure it’s appropriate for the venue and meets the standards. Once that happens, you’ll be instructed about service.

When that happens, I’ll let you know what the next steps are like. Stay tuned…